Jeeps are popular vehicles. Many people love them. But some wonder about insurance costs. Are they high? Let’s find out.

What is Insurance?

Insurance helps protect you. If your car gets damaged, insurance can pay. It is a safety net. You pay for it every month or year.

Why Some Cars Cost More to Insure

Different cars cost different amounts to insure. Some are more expensive. But why?

- Car Type: Sports cars can cost more to insure. Jeeps are not sports cars.

- Repair Costs: Some cars cost more to fix. This can raise insurance costs.

- Safety Features: More safety means less risk. Safer cars can be cheaper to insure.

- Owner’s Driving Record: Good drivers pay less. Bad drivers pay more.

Credit: stories.simplyioa.com

Jeeps and Insurance

Jeeps are known for off-road fun. They are strong and tough. But are they costly to insure? Let’s look at the factors.

Factors That Affect Jeep Insurance

Several things affect Jeep insurance costs. Here they are:

| Factor | Description |

|---|---|

| Model | Different Jeep models cost different to insure. |

| Usage | Do you drive off-road? This can change costs. |

| Location | Living in a busy city? You might pay more. |

| Age | Older cars might cost less to insure. |

Popular Jeep Models

Let’s explore some popular Jeep models. Each model has different insurance costs.

- Jeep Wrangler: A favorite for off-road lovers.

- Jeep Cherokee: Great for families and city driving.

- Jeep Grand Cherokee: Offers comfort and power.

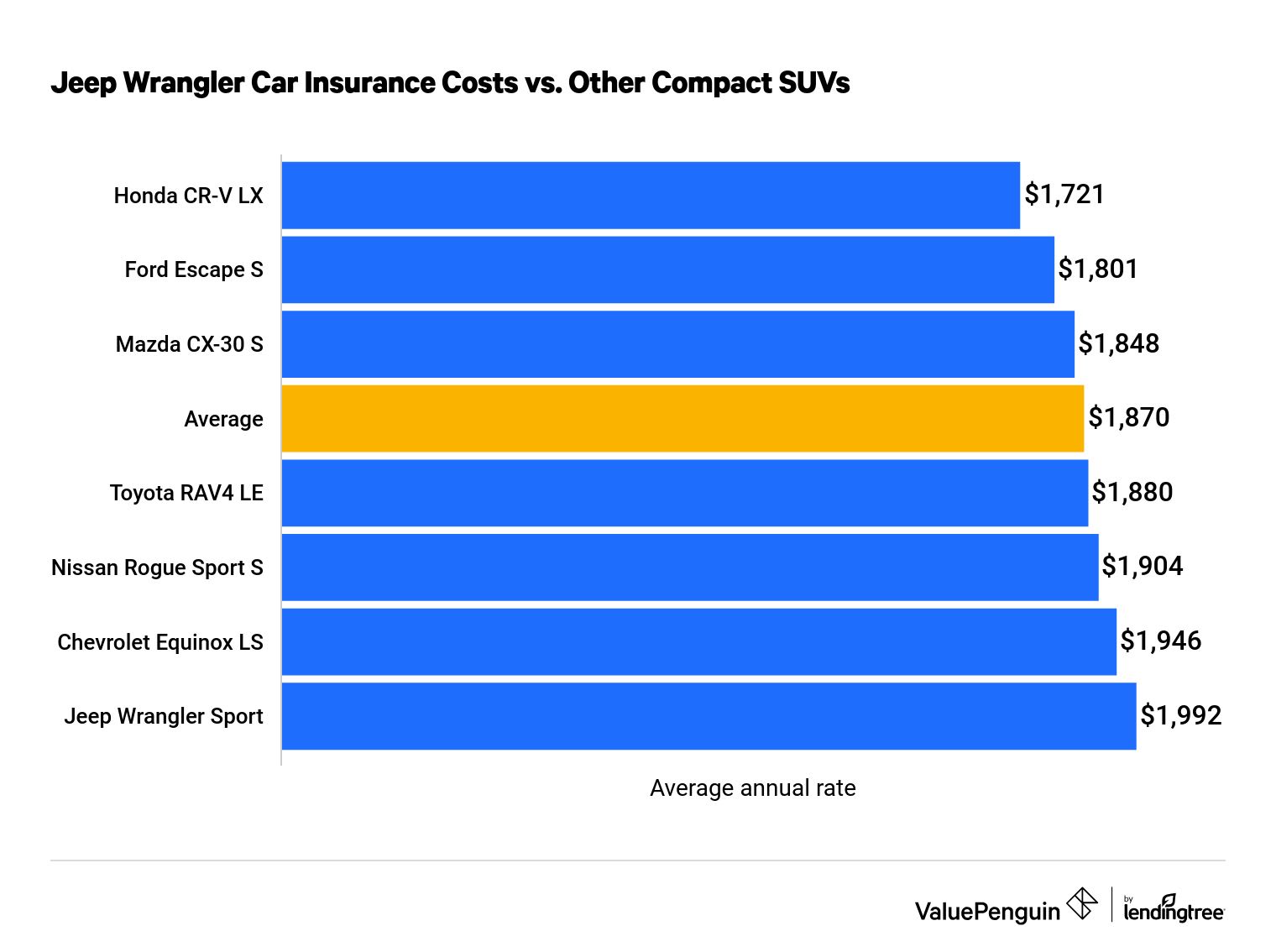

Jeep Wrangler Insurance

The Jeep Wrangler is popular. It’s great for adventure. Insurance for Wranglers can vary. Why? Because of off-road usage. Wranglers are often used off-road. This can increase insurance costs.

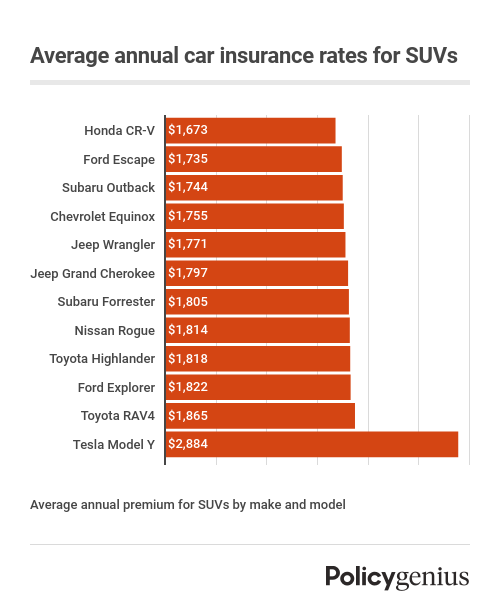

Credit: www.policygenius.com

Jeep Cherokee Insurance

The Cherokee is different. It’s used for daily drives. Families love it. Insurance costs are often moderate. It’s not as adventurous as the Wrangler.

Jeep Grand Cherokee Insurance

Grand Cherokees are bigger. They offer luxury and strength. Insurance can be higher. Why? Because of its value and features.

Ways to Lower Jeep Insurance Costs

You can save money on Jeep insurance. Here are some tips:

- Drive Safely: Fewer accidents mean lower costs.

- Shop Around: Different companies have different prices.

- Ask About Discounts: Some companies offer special discounts.

- Increase Deductible: A higher deductible can lower your premium.

Frequently Asked Questions

Why Are Jeeps Expensive To Insure?

Jeeps often have higher insurance rates due to their off-road capabilities, which may lead to more accidents.

Does Jeep Model Affect Insurance Cost?

Yes, different Jeep models have varying repair costs and safety features, impacting insurance premiums.

Do Jeep Wranglers Have High Insurance Rates?

Jeep Wranglers can be costly to insure because of their off-road use and theft rates.

Can Driving History Affect Jeep Insurance?

Absolutely. A clean driving record can lower your insurance premiums, even for a Jeep.

Conclusion

Jeeps can be expensive to insure. But not always. It depends on many factors. The model, how you use it, and your location matter. Consider these factors and tips. They can help you save money. Enjoy your Jeep adventures!

Leave a Reply