Are Jeep Wranglers Expensive to Insure? Uncover Costs

Many people love Jeep Wranglers. They are fun and strong. But, are they expensive to insure? This is a big question for many drivers. Let’s find out.

What Makes Jeep Wranglers Special?

Jeep Wranglers are unique. They can drive on rough roads. They have a tough look. Many people enjoy off-road adventures with them.

Why Insurance Costs Matter

Insurance is important for every driver. It protects you and your car. But, insurance can be costly. Knowing what affects costs is key.

Credit: www.valuepenguin.com

Credit: www.ledfactorymart.com

Factors Affecting Insurance Costs

Many factors affect car insurance. Let’s look at some key ones for Jeep Wranglers.

Car Model And Year

Newer models often cost more to insure. They have more features. These features can be expensive to repair.

Safety Features

Jeep Wranglers have strong safety features. These features can lower insurance costs. Insurers like safe cars.

Driving Record

Your driving history matters. If you have accidents, costs go up. Safe drivers pay less.

Location

Where you live affects insurance. Cities often have higher rates. More people, more chances of accidents.

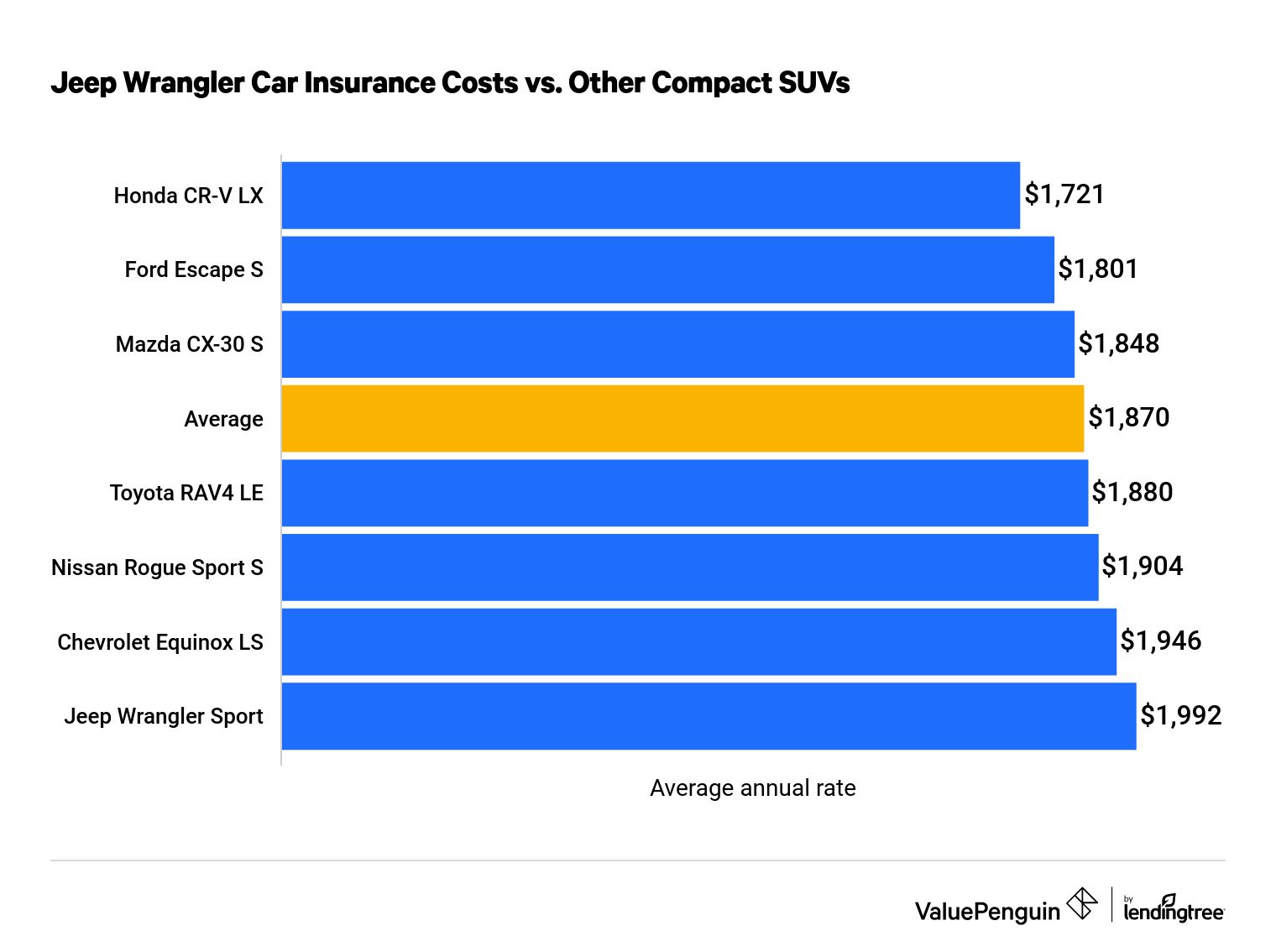

Comparing Jeep Wranglers with Other Cars

Are Wranglers more costly to insure than other cars? Let’s compare.

Jeep Wranglers Vs. Sedans

Sedans are common. They usually cost less to insure. Wranglers are bigger. Bigger cars sometimes cost more.

Jeep Wranglers Vs. Suvs

Wranglers are similar to SUVs. Both have high insurance rates. They are larger and more expensive to repair.

Ways to Save on Insurance

Want to save money? Here are some tips.

Choose A Higher Deductible

Higher deductibles mean lower premiums. But, you’ll pay more if you have an accident.

Bundle Insurance Policies

Many insurers offer discounts. Bundle your car and home insurance. This can save money.

Ask For Discounts

Many companies offer discounts. Safe driver? Good student? Ask your insurer.

Shop Around

Not all insurers are the same. Compare quotes from different companies. You might find a better deal.

Frequently Asked Questions

Are Jeep Wranglers More Expensive To Insure Than Other Suvs?

Jeep Wranglers often have higher insurance costs. Due to their off-road capabilities and repair costs.

What Factors Affect Jeep Wrangler Insurance Rates?

Factors include driver age, location, driving history, and the Wrangler’s model year.

Do Modifications Increase Jeep Wrangler Insurance Premiums?

Yes, modifications can raise premiums. Insurers see them as higher risk.

Are Newer Jeep Wranglers Cheaper To Insure?

Not necessarily. Newer models may have higher insurance due to their value.

Conclusion

Jeep Wranglers are special vehicles. They might cost more to insure. But, with smart choices, you can save money. Consider all factors before deciding. Understand your needs. Make the right choice for you.

Key Points to Remember

- Jeep Wranglers are unique and fun.

- Insurance costs depend on many factors.

- Newer models often cost more to insure.

- Safety features can lower costs.

- Driving record and location matter.

- Wranglers can be more costly than sedans.

- You can save money with smart choices.